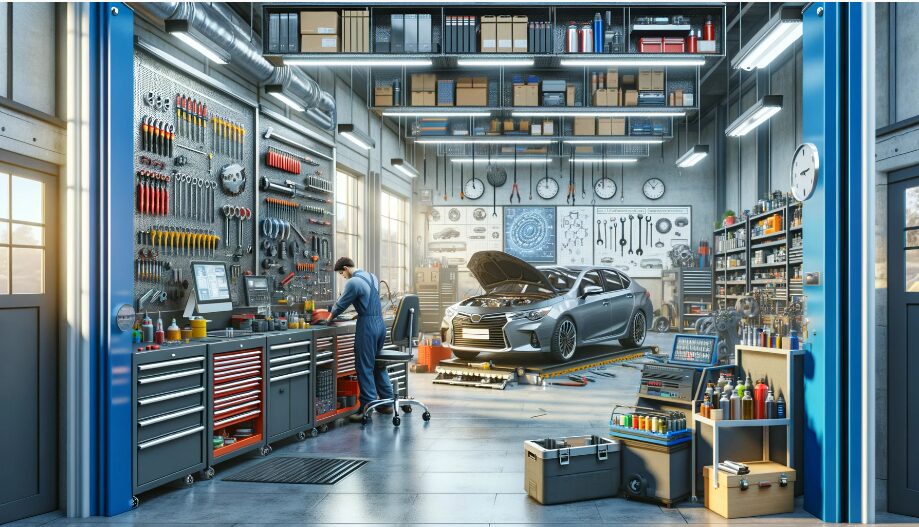

Running a repair shop isn’t just about fixing cars or appliances—it’s about having the right tools and equipment to get the job done efficiently. However, purchasing and maintaining this equipment can be costly. That’s where equipment financing comes in. By providing the funds necessary to acquire and upgrade essential tools, equipment financing helps repair shops stay competitive and operational without breaking the bank.

The Basics of Equipment Financing

Equipment financing is essentially a loan or lease that helps businesses acquire necessary machinery, tools, and other equipment. Instead of paying a lump sum upfront, businesses can spread the cost over time, making it more manageable and preserving cash flow.

Types of Equipment Financing

- Equipment Loans

- Equipment Leases

- Equipment Finance Agreements (EFAs)

Benefits of Equipment Financing

- Improved Cash Flow: Spread out payments over time, keeping more cash in hand for day-to-day operations.

- Access to the Latest Technology: Upgrade to new equipment without large upfront costs.

- Tax Advantages: Potential tax deductions for interest payments and depreciation.

- Flexibility: Choose from various financing options that best fit your business needs.

Choosing the Right Financing Option

Selecting the right financing option depends on several factors:

- Budget: Assess your budget and cash flow. Can you afford the monthly payments?

- Equipment Lifespan: Consider how long you’ll need the equipment. For long-term use, loans might be better; for short-term or rapidly evolving tech, leases could be ideal.

- Ownership Preference: Do you prefer to own your equipment or is leasing more advantageous?

- Credit Score: Your credit score can influence the financing terms you qualify for.

Steps to Secure Equipment Financing

- Evaluate Your Needs: Identify the equipment required and its cost.

- Check Your Credit: Review your credit score and history.

- Research Lenders: Look for lenders specializing in equipment financing for repair shops.

- Prepare Documentation: Gather financial statements, tax returns, and a business plan.

- Apply for Financing: Submit applications to multiple lenders to compare offers.

Common Questions About Equipment Financing

Q1: How long does the financing process take? A1: It can vary, but typically from a few days to a couple of weeks.

Q2: Can I finance used equipment? A2: Yes, many lenders finance both new and used equipment.

Q3: What if I have bad credit? A3: While it may be more challenging, some lenders specialize in bad credit financing or offer higher interest rates to mitigate their risk.

Conclusion

Equipment financing can be a lifeline for repair shops looking to expand, upgrade, or simply maintain their operational efficiency. By understanding your options and carefully choosing the right financing solution, you can ensure your repair shop remains competitive and well-equipped to handle any challenge.

So, what are you waiting for? Explore your equipment financing options today and give your repair shop the boost it deserves!

#EquipmentFinancing #RepairShopSuccess #BusinessGrowth #FinanceSolutions #SmallBusinessSupport

Follow for more: https://www.fenixsolutions.io/blog/